Lokale Suchergebnisse

GETBLUE Digitale Lösungen hilft Ihnen von Kunden vor Ort gefunden zu werden die nach genau den Produkten und Dienstleistungen suchen die Sie anbieten, genau in Ihrer Stadt! Und nicht nur dort, sondern auch in ALLEN Städten in einem von Ihnen festgelegten Umkreis Ihres Standortes!

Laut einer von Google in Auftrag gegebenen Studie tragen lokale Suchanfragen bei zwei Dritteln der Konsumenten wesentlich zur Kaufentscheidung bei. Das bedeutet für Sie ein enormes Potential Ihrer Konkurrenz voraus zu sein. Knapp die Hälfte der Personen werden noch innerhalb einer Stunde nach ihrer Suchanfrage aktiv und besuchen beispielsweise Ihr Geschäft.

Interessant ist besonders die Anzahl der Verbraucher, die im Anschluss an ihre lokale Suche im Netz binnen eines Tages ein stationäres Geschäft aufsuchte: 50 Prozent der Smartphone-User und 34 Prozent der Computer- bzw. Tablet-Nutzer gingen anschließend in das gesuchte Geschäft. Sollten Sie nicht findbar sein oder Ihre Internetseite nicht auf den Smartphones aufrufbar und lesbar sein dreht Ihnen diese Masse an potentiellen Kunden den Rücken zu.

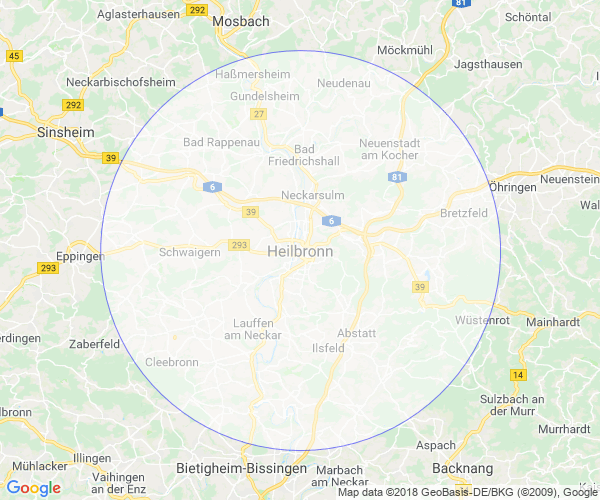

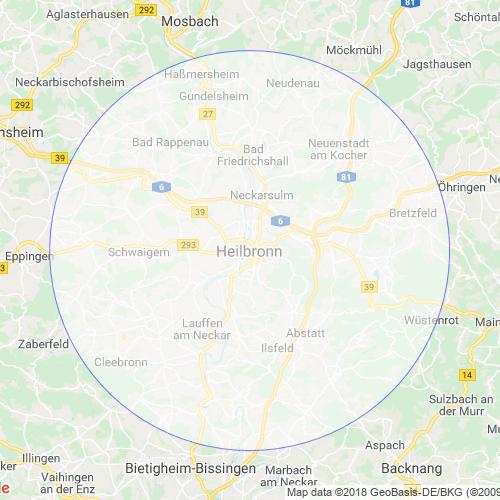

Dass Sie gefunden werden wenn ein potentieller Kunde nach einem Geschäft Ihrer Art in seiner Umgebung sucht ist unsere Aufgabe. Sie legen fest in welchem Umkreis und in welchen Städten Sie mit Ihrer Internetseite gefunden werden wollen und wir machen uns ans Werk um Sie genau dort sichtbar zu machen!

Sie wollen zum Beispiel in einem Umkreis von 20 Kilometern von Heilbronn aus jeden möglichen Kunden welcher nach einem Unternehmen Ihrer Art sucht direkt Ihre Internetseite als eine der ersten sehen lassen?

- Wir suchen für Sie alle Städte in diesem Umkreis heraus.

- Wir optimieren Ihre Webseite um genau dann gefunden zu werden, wenn von dort aus lokale Suchen gestartet werden.

- Die Kunden werden auf speziell vorbereitete Seiten geleitet die es Ihnen ermöglicht diese für sich zu gewinnen.

Lokale Suchergebnisse werden immer wichtiger!

Wie wäre es wenn Potentielle Neukunden egal aus welchem Ort sie Ihre Internet Suche starten immer auf Ihre stummen Verkäufer… Ihre Regio Seiten treffen!?

Permanente Sichtbarkeit OHNE LAUFENDE KOSTEN!

Angeln Sie sich auch mehr Kunden!

Aus Ihrem regionalen Umkreis…